J.P. Morgan has created what’s arguably considered one of the largest blockchain bills networks up to now.

The financial offerings employer announced that the Royal bank of Canada and Australia and New Zealand Banking institution Ltd. are the first banks to sign up for the blockchain network, “representing full-size go-border fee volumes.”

J.P. Morgan created the Interbank records network (IIN), which it stated will notably lessen the range of members needed to reply to compliance and different records-related inquiries that postpone payments.

“IIN will enhance the patron revel in, lowering the amount of time – from weeks to hours – and prices related to resolving fee delays,” said Emma Loftus, Head of global payments and FX, J.P. Morgan Treasury offerings. “Blockchain abilities have allowed us to rethink how crucial records can be sourced and exchanged between international banks.”

Other banks are predicted to sign up for the IIN within the coming months, J.P. Morgan stated.

The IIN unveiling got here after a Polynesian bills system provider and IBM unveiled their own pass-border blockchain payments service. That FinTech community became heralded as being able to enhance performance and decrease the fee for making international payments for business and customers.

IBM’s Blockchain Platform, a cloud service, was used to permit the electronic trade of 12 one of a kind currencies throughout Pacific Islands in addition to Australia, New Zealand, and the UK.

KlickEx organization, a United international locations-funded, Pacific-area monetary services company, and Stellar.org, a nonprofit agency that supports an open-source blockchain network for financial services, are backing the brand new go-border payments provider powered by using IBM’s platform.

Bills made and received through KlickEx transfer among financial institution money owed inside the Pacific Islands and Australia, New Zealand and Europe; the carrier also allows clients in developing countries to transfer finances at once to cell wallets.

He financial institution of Britain is also piloting blockchain generation to create an extra efficient and less luxurious bills, clearing and agreement network.

Pass-border bills are complicated because of regulatory standards

Emerging technologies together with blockchain, device gaining knowledge of and robotics are being deployed by J.P. Morgan to enhance systems and broaden innovative answers.

In the case of cross-border payments, processing is complicated and includes more than one layers of communication amongst price contributors to verify transactions – an operation known as payment and settlement.

In advance this yr, Accenture launched a file claiming blockchain technology ought to lessen infrastructure fees for eight of the arena’s 10 biggest investment banks by a mean of 30%, “translating to $8 billion to $12 billion in annual fee financial savings for the one’s banks.”

Payments, clearance and agreement inside the financial offerings industry – consisting of stock markets – is rife with inefficiencies because each company within the method keeps its own records and have to talk with the others thru electronic messaging about where it is inside the technique. because of that, settlements typically take days. In turn, delays in settlements pressure banks to set aside cash that would otherwise be invested.

Due to the fact it can instantly proportion records with every agency involved in a blockchain database or ledger, the generation reduces or eliminates the want for reconciliation, confirmation and alternate smash evaluation as key components of a more efficient and powerful clearance and settlement technique, according to Accenture.

“It is a totally warm topic right now,” Zulfikar Ramzan, CTO of RSA protection, said in an earlier interview with Computerworld. “we are actually getting a whole lot of inbound inquiries round blockchain and its implication inside corporation environments.”

Ramzan said his customers are asking about blockchain for audit logging and or verifiable logs, that’s considered as a dependable way of tracking what passed off in an agency to fulfill regulatory auditors. different RSA customers are inquisitive about it for consumer authentication to ensure users are accessing the perfect digital data at the proper time.

By way of leveraging blockchain generation, the new IIN “will appreciably reduce the range of participants currently had to reply to compliance and different records-related inquiries that delay payments,” J.P. Morgan stated.

So what is blockchain?

The blockchain is a public electronic ledger – much like a relational database – that may be overtly shared among disparate customers and that creates a unchangeable record in their transactions, each one time-stamped and linked to the previous one.

Each virtual document or transaction within the thread is called a block (for this reason the call), and it lets in either an open or controlled set of users to participate inside the electronic ledger. every block is related to a particular participant.

Whilst it natively provides a stage of safety due to the fact blocks can not be changed, encryption is also introduced as an additional safeguard towards intrusion.

Blockchain can most effectively be updated by consensus among contributors inside the machine, and while new data is entered, it could never be erased. The blockchain consists of a true and verifiable record of every and each transaction ever made within the gadget.

As a peer-to-peer community, blended with a disbursed time-stamping server, blockchain databases can be controlled autonomously. there’s no need for an administrator. In effect, the customers are the administrator.

The brand new IIN turned into evolved in-residence by way of J.P. Morgan and is powered by Quorum, a permission-variation of the Ethereum blockchain. Quorum’s cognizance on privateness allows cozy facts sharing through IIN, the bank said.

Alex Tapscott, the CEO and founding father of Northwest Passage Ventures, a challenge capital company that invests in blockchain era organizations, stated at the same time as no gadget is “unhackable,” blockchain’s easy topology is the most secure of any community today.

“With a view to flow anything of fee over any type of blockchain, the network [of nodes] must first agree that that transaction is legitimate, which means that no unmarried entity can move in and say one way or the alternative whether or now not a transaction occurred,” Tapscott said. “To hack it you would not simply should hack one system like in a bank…, you’d have to hack each unmarried laptop on that network, that is preventing towards you doing that.”

More from TECH

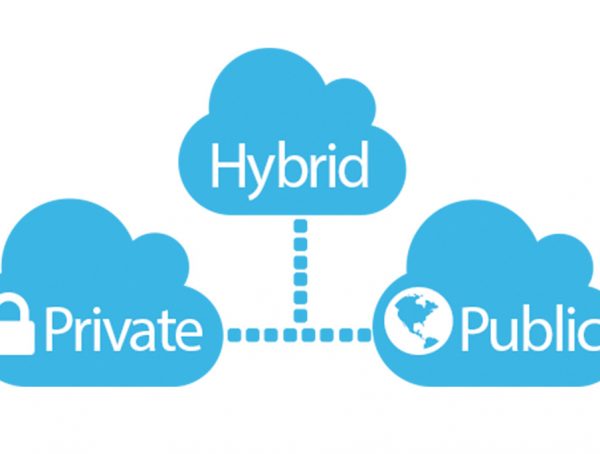

What Is Hybrid Cloud Computing?

Hybrid cloud: Many consider it’s the eventual kingdom that most organizations will function in – some infrastructure resources on premises, …

Dell Integrates Desktop, Mobile Management for Uem

Dell has integrated its cloud-based desktop management console with AirWatch's mobile platform to create a single console that allows admins …

Windows 10 Update (and Retirement) Calendar: Mark These Dates

Microsoft's shift to windows-as-a-service (WaaS) for home windows 10 crafted a repetitive, predictable schedule of model launch and aid expiration …